Blog

Clear • Secure • Tailored Mortgage Solutions

Residential Market Commentary - Uneventful Budget But Unemployment Improves – November 10 2025

November 10, 2025 | Posted by: Matthew J. Charlton

Last week’s federal budget generated plenty of headlines, mostly based around bloating deficits and federal job cuts, but there was almost nothing new for the housing and mortgage sectors. Virt ...

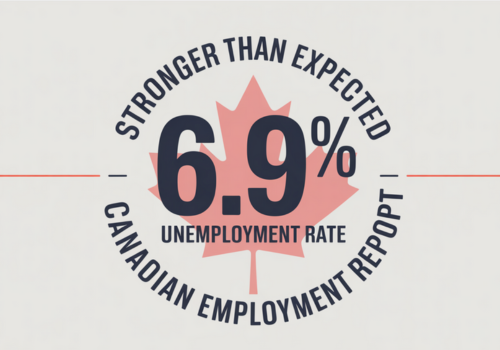

read moreStronger-Than-Expected Jobs Report Takes a December BoC Rate Cut Off The Table – November 7 2025

November 7, 2025 | Posted by: Matthew J. Charlton

Forget A December BoC Rate Cut: October Labour Force Survey Much Stronger Than Expected Today’s Labour Force Survey for October showed a stronger-than-expected net employment gain of 66,600, on ...

read moreCanadian Federal Budget Revamp – November 4 2025

November 4, 2025 | Posted by: Matthew J. Charlton

Federal Budget Revamp, FY 2025-2026 Today, Finance Minister François-Philippe Champagne presented his first budget. Mark Carney was elected Prime Minister with a mandate to transform Canada' ...

read moreResidential Market Commentary - BoC signals a halt to rate cuts – November 3 2025

November 3, 2025 | Posted by: Matthew J. Charlton

The Bank of Canada did as it was expected to last week and cut its trend-setting Policy Rate by 25 basis-points. It now sits at 2.25%. The central bank has shifted its economic focus away from infla ...

read moreInterest Rate Announcement – October 29 2025

October 29, 2025 | Posted by: Matthew J. Charlton

BREAKING: The Bank of Canada has lowered its benchmark interest rate by 25 bps to 2.25%The next rate announcement is scheduled for Wednesday, December 10 2025.'We welcome the decision for the Ban ...

read moreResidential Market Commentary - Another rate cut seems likely – October 27 2025

October 27, 2025 | Posted by: Matthew J. Charlton

Canada’s latest inflation numbers have softened expectations for another rate cut by the Bank of Canada, but not by much. The September inflation report from Statistics Canada showed the ...

read moreResidential Market Commentary - The latest analysis from CREA – October 20 2025

October 20, 2025 | Posted by: Matthew J. Charlton

Increasing home resales across Canada took a breather in September, but prices held fairly steady. The Canadian Real Estate Association’s latest report shows sales dipped 1.7% last month compa ...

read moreNational Home Sales Fall In September, Breaking A Five-Month Streak - October 16 2025

October 16, 2025 | Posted by: Matthew J. Charlton

Canadian Home Sales Post Best September In Four Years Today’s release of the September housing data by the Canadian Real Estate Association (CREA) showed a pullback on the housing front. The ...

read moreRE/MAX CANADA - Fall Housing Outlook

October 2, 2025 | Posted by: Matthew J. Charlton

'54% of Canadians believe this fall is a good time to strike a deal on a home.' Here’s a summary of the RE/MAX Canada Fall 2025 Housing Market Outlook piece, released Sept 21st:Pricing Trends: ...

read moreThe Bank of Canada Lowers the Policy Rate By 25 Basis Points to 2.5% - September 17 2025

September 17, 2025 | Posted by: Matthew J. Charlton

Bank of Canada Lowers Policy Rate to 2.5% Today, the Bank of Canada lowered the overnight policy rate by 25 bps to 2.5% as was widely expected. Following yesterday's better-than-expected inflation re ...

read more