Blog

Clear • Secure • Tailored Mortgage Solutions

Category: Latest News (138 posts)

Residential Market Commentary - Uneventful Budget But Unemployment Improves – November 10 2025

November 10, 2025 | Posted by: Matthew J. Charlton

Last week’s federal budget generated plenty of headlines, mostly based around bloating deficits and federal job cuts, but there was almost nothing new for the housing and mortgage sectors. Virt ...

read moreStronger-Than-Expected Jobs Report Takes a December BoC Rate Cut Off The Table – November 7 2025

November 7, 2025 | Posted by: Matthew J. Charlton

Forget A December BoC Rate Cut: October Labour Force Survey Much Stronger Than Expected Today’s Labour Force Survey for October showed a stronger-than-expected net employment gain of 66,600, on ...

read moreCanadian Federal Budget Revamp – November 4 2025

November 4, 2025 | Posted by: Matthew J. Charlton

Federal Budget Revamp, FY 2025-2026 Today, Finance Minister François-Philippe Champagne presented his first budget. Mark Carney was elected Prime Minister with a mandate to transform Canada' ...

read moreResidential Market Commentary - BoC signals a halt to rate cuts – November 3 2025

November 3, 2025 | Posted by: Matthew J. Charlton

The Bank of Canada did as it was expected to last week and cut its trend-setting Policy Rate by 25 basis-points. It now sits at 2.25%. The central bank has shifted its economic focus away from infla ...

read moreInterest Rate Announcement – October 29 2025

October 29, 2025 | Posted by: Matthew J. Charlton

BREAKING: The Bank of Canada has lowered its benchmark interest rate by 25 bps to 2.25%The next rate announcement is scheduled for Wednesday, December 10 2025.'We welcome the decision for the Ban ...

read moreResidential Market Commentary - Another rate cut seems likely – October 27 2025

October 27, 2025 | Posted by: Matthew J. Charlton

Canada’s latest inflation numbers have softened expectations for another rate cut by the Bank of Canada, but not by much. The September inflation report from Statistics Canada showed the ...

read moreResidential Market Commentary - The latest analysis from CREA – October 20 2025

October 20, 2025 | Posted by: Matthew J. Charlton

Increasing home resales across Canada took a breather in September, but prices held fairly steady. The Canadian Real Estate Association’s latest report shows sales dipped 1.7% last month compa ...

read moreNational Home Sales Fall In September, Breaking A Five-Month Streak - October 16 2025

October 16, 2025 | Posted by: Matthew J. Charlton

Canadian Home Sales Post Best September In Four Years Today’s release of the September housing data by the Canadian Real Estate Association (CREA) showed a pullback on the housing front. The ...

read moreRE/MAX CANADA - Fall Housing Outlook

October 2, 2025 | Posted by: Matthew J. Charlton

'54% of Canadians believe this fall is a good time to strike a deal on a home.' Here’s a summary of the RE/MAX Canada Fall 2025 Housing Market Outlook piece, released Sept 21st:Pricing Trends: ...

read moreThe Bank of Canada Lowers the Policy Rate By 25 Basis Points to 2.5% - September 17 2025

September 17, 2025 | Posted by: Matthew J. Charlton

Bank of Canada Lowers Policy Rate to 2.5% Today, the Bank of Canada lowered the overnight policy rate by 25 bps to 2.5% as was widely expected. Following yesterday's better-than-expected inflation re ...

read moreInterest Rate Announcement – September 17 2025

September 17, 2025 | Posted by: Matthew J. Charlton

BREAKING: Bank of Canada cuts policy rate by 25 bps to 2.50% and the prime rate to 4.70%. This is the Bank’s eighth rate cut.The next rate announcement is scheduled for Wednesday, October 2 ...

read moreHeadline Inflation Rises Less Than Expected, Giving the Green Light to BoC Easing – September 16 2025

September 16, 2025 | Posted by: Matthew J. Charlton

Canadian Inflation More Muted Than Expected, Giving the Green Light for BoC Easing Tomorrow The Consumer Price Index (CPI) rose 1.9% on a year-over-year basis in August, up from a 1.7% increase in Ju ...

read moreCanadian Housing Market Turns the Corner in August – September 15 2025

September 15, 2025 | Posted by: Matthew J. Charlton

Canadian Home Sales Post Best August In Four Years Today's release of the August housing data by the Canadian Real Estate Association (CREA) showed good news on the housing front. The number of hom ...

read moreResidential Market Commentary - Odds Favour a Rate Cut – September 9 2025

September 9, 2025 | Posted by: Matthew J. Charlton

Canada’s latest employment report has significantly increased the likelihood of an interest rate cut by the Bank of Canada on September 17. Statistics Canada’s Labour Force Survey (LFS) ...

read moreEmployment data for August came in weaker than expected in both Canada and the US – September 5 2025

September 5, 2025 | Posted by: Matthew J. Charlton

Weak August Jobs Report in Canada Bodes Well for a BoC Rate Cut Today's Labour Force Survey for August was weaker than expected, indicating an excess supply in the labour market and the economy. Empl ...

read moreEconomic Insights from Dr. Sherry Cooper – September 2 2025

September 2, 2025 | Posted by: Matthew J. Charlton

The Bank of Canada has maintained its target for the overnight rate at 2.75% since March 12. This was the seventh consecutive cut since mid-2024, when the Bank began lowering the rate from 5.0% in re ...

read moreBigger Than Expected Drop in Canadian GDP in Q2 – August 29 2025

August 29, 2025 | Posted by: Matthew J. Charlton

Tariff Turmoil Takes Its Toll Statistics Canada released Q2 GDP data, showing a weaker-than-expected -1.6% seasonally adjusted annual rate, in line with the Bank of Canada's forecast, but a larger ...

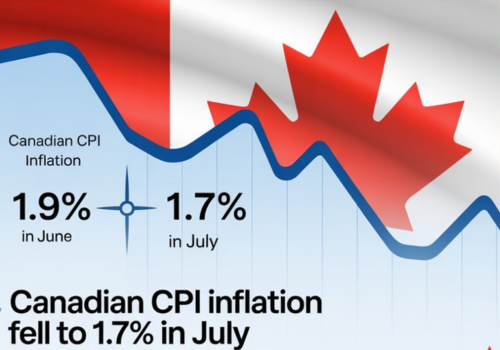

read moreCanadian CPI Inflation Decelerated to 1.7% in July, from 1.9% in June mainly on lower oil prices. – August 19 2025

August 19, 2025 | Posted by: Matthew J. Charlton

Today's CPI Report Shows Headline Inflation Cooling, But Core Inflation Remains Troubling Canadian consumer prices decelerated to 1.7% y/y in July, a bit better than expected and down two ticks from ...

read moreGood News on the Housing Front As Sales Rose 3.8% m/m in July – August 15 2025

August 15, 2025 | Posted by: Matthew J. Charlton

Canadian Homebuyers Return in July, Posting the Fourth Consecutive Sales Gain Today's release of the July housing data by the Canadian Real Estate Association (CREA) showed good news on the housing ...

read moreResidential Market Commentary - Waiting for More Data

August 12, 2025 | Posted by: Matthew J. Charlton

The Bank of Canada’s next interest rate announcement is set for September 17. Between now and then there will be plenty of economic data to digest. The latest significant report was Statistics ...

read moreThe July Labour Force Report showed a weaker-than-expected decline in net employment – August 8 2025

August 8, 2025 | Posted by: Matthew J. Charlton

Canada's July Labour Force Survey Was the Weakest Since 2022 Employment fell by 40,800 jobs in July, a weak start to the third quarter, driven by decreases in full-time work, with most of the decline ...

read moreEconomic Insights from Dr. Sherry Cooper - August 5 2025

August 5, 2025 | Posted by: Matthew J. Charlton

Most market participants did not expect the Bank of Canada to cut rates in late July. Incoming economic data paint a somewhat stronger picture. Consumer sentiment remains relatively weak in the face ...

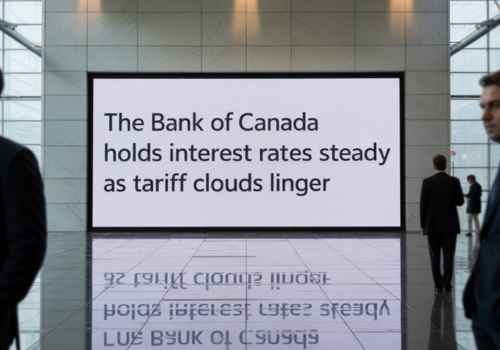

read moreBank of Canada Holds Rates Steady as Tariff Clouds Linger – July 30 2025

July 30, 2025 | Posted by: Matthew J. Charlton

Bank of Canada Holds Rates Steady As Tariff Turmoil Continues As expected, the Bank of Canada held its benchmark interest rate unchanged at 2.75% at today's meeting, the third consecutive rate hold ...

read moreInterest Rate Announcement – July 30 2025

July 30, 2025 | Posted by: Matthew J. Charlton

As expected, the Bank of Canada left its policy rate unchanged at 2.75%.The next rate announcement is scheduled for Wednesday, September 17 2025.'The Bank of Canada faced a tough decision with the eco ...

read moreResidential Market Commentary - Bank of Canada Gauges Sentiment – July 28 2025

July 28, 2025 | Posted by: Matthew J. Charlton

Canadian business and consumer concerns about the economy have eased, but confidence is still shaky according to the Bank of Canada. The Bank’s regular quarterly reports on business and consum ...

read moreResidential Market Commentary - Real Estate Rebound – July 23 2025

July 23, 2025 | Posted by: Matthew J. Charlton

Market watchers across the country are talking about a real estate recovery.Much of the optimism is based on sales and pricing results over the past two months. The June figures from the Canadian Re ...

read moreCanadian Housing Might Be Turning A Corner As Sales Picked Up in June and Prices Flattened - July 16 2025

July 16, 2025 | Posted by: Matthew J. Charlton

Home Sales Rose As Prices Stabilized--Housing Market is Turning a Corner The number of home sales recorded over Canadian MLS® Systems rose 2.8% on a month-over-month basis in June 2025, buildin ...

read moreCanadian Inflation Accelerates by 1.9% y/y in June; US inflation comes in below forecast for the fifth consecutive month. - July 15 2025

July 15, 2025 | Posted by: Matthew J. Charlton

Today's Report Shows Inflation Remains a Concern, Forestalling BoC Action Canadian consumer prices accelerated for the first time in four months in June, and underlying price pressures firmed, likely ...

read moreCanada Unexpectedly Adds 83,100 Jobs in June, The Biggest Gain of 2025 - July 11 2025

July 11, 2025 | Posted by: Matthew J. Charlton

Canada's Economy Shows Amazing Resilience in June The Canadian economy refuses to buckle under the weight of tariff uncertainty and further potential tariff hikes. The Labour Force Survey, released ...

read moreEconomic Insights from Dr. Sherry Cooper - July 1 2025

July 1, 2025 | Posted by: Matthew J. Charlton

Canadian economic data have come in weaker than expected since early May. Despite this, markets are not looking for another rate cut in July unless core inflation falls meaningfully. Amid a sizeable ...

read moreResidential Market Commentary - Bank of Canada balancing act - June 30 2025

June 30, 2025 | Posted by: Matthew J. Charlton

Expert opinions on Bank of Canada interest rate cuts are shifting. A growing number of market watchers are backing away from their predictions of two more reductions this year. Several are now sayi ...

read moreCanadian GDP is Set To Contract In Q2 - June 27 2025

June 27, 2025 | Posted by: Matthew J. Charlton

Canada Is Headed For A Moderate Economic Contraction in Q2 Real gross domestic product (GDP) edged down 0.1% in April, following a 0.2% increase in March. The preliminary estimate for May was also ...

read moreCanadian CPI inflation held steady at 1.7% y/y in May. Core inflation edged downward - June 24 2025

June 24, 2025 | Posted by: Matthew J. Charlton

Today's Report Shows Inflation Remains a Concern The Consumer Price Index (CPI) rose 1.7% year-over-year in May, matching the 1.7% increase in April.A reduced rent price increase and a decline in tra ...

read moreResidential Market Commentary - Renters Retreat From the Market

June 23, 2025 | Posted by: Matthew J. Charlton

A key segment of Canada’s first-time homebuyer market appears to be delaying its purchasing plans. A new survey by real estate giant Royal LePage suggests renters are holding back, waiting fo ...

read moreCanadian National Home Sales Were Up 3.6% Month-over-Month - June 16 2025

June 16, 2025 | Posted by: Matthew J. Charlton

Global Tariff Uncertainty Sidelines Buyers Canadian existing home sales recorded over the MLS Systems climbed 3.6% between April and May, a normally strong month for housing, marking the first gain ...

read moreResidential Market Commentary - BoC holds rate steady – June 9 2025

June 9, 2025 | Posted by: Matthew J. Charlton

The Bank of Canada has stayed on the sidelines for its second rate setting in a row, so Canadians hoping for some interest rate relief are going to have to wait a little longer. The central bank&rs ...

read moreWeak Canadian Labour Report in May Points Towards BoC Easing - June 6 2025

June 6, 2025 | Posted by: Matthew J. Charlton

Labour Market Weakness Continued in May, Raising the Prospects of a Rate Cut at The Next BoC Meeting Today's Labour Force Survey for March was weaker than expected. Employment decreased by 33,000 (-0 ...

read moreBank of Canada Holds Rates Steady for Second Consecutive Meeting - June 4 2025

June 4, 2025 | Posted by: Matthew J. Charlton

Bank of Canada Holds Rates Steady for the Second Consecutive Meeting--But Two More Rate Cuts Are Likely This Year As expected, the Bank of Canada held its benchmark interest rate unchanged at 2.75% ...

read moreInterest Rate Announcement - June 4 2025

June 4, 2025 | Posted by: Matthew J. Charlton

As expected, the Bank of Canada left its policy rate unchanged at 2.75%.The next rate announcement is scheduled for Wednesday, July 30 2025.'We understand the challenges the Bank of Canada is currentl ...

read moreEconomic Insights from Dr. Sherry Cooper - June 3 2025

June 3, 2025 | Posted by: Matthew J. Charlton

The Trump Tariff Mayhem Has Significantly Impacted the Canadian Economy and Financial Markets. Since the February tariff threats and the on-again, off-again nature of the policy changes, consumer an ...

read moreQ1 Canadian GDP Comes In Stronger Than Expected Owing to Tariffs - June 2 2025

June 2, 2025 | Posted by: Matthew J. Charlton

Q1 GDP Growth Was Bolstered by Tariff Reaction As Residential Construction and Resale Activity Weakened Further Statistics Canada released Q1 GDP data showing a stronger-than-expected 2.2% seasonal ...

read moreCanadian headline inflation fell to 1.7% y/y in April owing to end of carbon tax and falling energy prices - May 20 2025

May 20, 2025 | Posted by: Matthew J. Charlton

Today's Inflation Report Poses a Conundrum for the Bank of Canada The headline inflation report for April showed a marked slowdown in the Consumer Price Index (CPI), which rose a mere 1.7% year over ...

read moreCanadian National Home Sales Unchanged In April As New Listings and Home Prices Fall - May 16 2025

May 16, 2025 | Posted by: Matthew J. Charlton

Global Tariff Uncertainty Sidelined Buyers Canadian existing home sales were unchanged last month as tariff concerns again mothballed home-buying intentions, mainly in the GTA and GVA where sales h ...

read moreInside Carney’s Cabinet - May 13 2025

May 13, 2025 | Posted by: Matthew J. Charlton

Prime Minister Mark Carney unveiled his first Cabinet since winning the general election, and his second since becoming Liberal Leader. Today’s Cabinet announcement marks an important mileston ...

read moreWeak Canadian Jobs Report for April As Tariffs Hit Manufacturing - May 9 2025

May 9, 2025 | Posted by: Matthew J. Charlton

Manufacturing Employment Plunged as Tariffs Weakened the Economy Today's Labour Force Survey for April showed a marked adverse impact of tariffs on the Canadian economy. Early evidence suggests that ...

read moreEconomic Insights from Dr. Sherry Cooper - May 6 2025

May 6, 2025 | Posted by: Matthew J. Charlton

President Trump’s second term, now just over 100 days long, has wreaked chaos worldwide. A selloff in US assets deepened as President Donald Trump stepped up criticism of Jerome Powell, Chairm ...

read moreResidential Market Commentary - New government faces old housing issues - April 29 2025

April 29, 2025 | Posted by: Matthew J. Charlton

The federal election is done and we now know what the government will look like for the foreseeable future. Among the key promises made during the election campaign were pledges to fix the country&r ...

read moreThe Bank of Canada holds rates steady in the face of tariff uncertainty - April 16 2025

April 16, 2025 | Posted by: Matthew J. Charlton

Bank of Canada Holds Rates Steady In The Face Of Tariff Uncertainty--More Rate Cuts Coming The Bank of Canada held its benchmark interest rate unchanged at 2.75% at today's meeting, as expected by ...

read moreInterest Rate Announcement - April 16 2025

April 16, 2025 | Posted by: Matthew J. Charlton

The Bank of Canada has left its benchmark rate unchanged at 2.75%The next rate announcement is scheduled for Wednesday, June 4, 2025.'The Bank of Canada faced a tough decision with the economic turbul ...

read moreLower-than-expected Canadian inflation in March may not be enough to prompt another Bank of Canada rate cut tomorrow - April 15 2025

April 15, 2025 | Posted by: Matthew J. Charlton

Weaker Than Expected Inflation May Not Be Enough to Trigger Another Bank of Canada Rate Cut Tomorrow Canadian consumer prices rose 0.3% in March (or remained flat when seasonally adjusted), which w ...

read moreWeak Canadian Job Creation Is The First Fallout From The Trade War - April 4 2025

April 4, 2025 | Posted by: Matthew J. Charlton

Weak Canadian Job Growth in March and Rising Unemployment Is the First Harbinger of a Trade-War-Induced Economic Slowdown Today's Labour Force Survey for March was weaker than expected. Employment ...

read moreEconomic Insights from Dr. Sherry Cooper - April 1 2025

April 1, 2025 | Posted by: Matthew J. Charlton

Since Donald Trump took office, all bets are off on the Canadian economic outlook. Most people expected more substantial growth and lower inflation as we moved into 2025. Trump’s tariffs, dere ...

read moreCanadian Inflation Jumped to 2.6% y/y in February As GST Tax Holiday Ended - March 18 2025

March 18, 2025 | Posted by: Matthew J. Charlton

Canadian Inflation Surged to 2.6% in February, Much Stronger Than Expected The Consumer Price Index (CPI) rose 2.6% year-over-year (y/y) in February, following an increase of 1.9% in January. With ...

read moreCanadian home sales plunged in February, spooked by tariff concerns - March 17 2025

March 17, 2025 | Posted by: Matthew J. Charlton

Global Tariff Uncertainty Sidelined Buyers Canadian existing home sales plunged last month as tariff concerns moth-balled home buying intentions. According to data released Monday by the Canadian R ...

read moreThe Bank of Canada Cut Rates by 25 bps On Tariff Concerns - March 12 2025

March 12, 2025 | Posted by: Matthew J. Charlton

Bank of Canada Cuts Policy Rate By Another 25 Basis Points The Bank of Canada (BoC) reduced the overnight rate by 25 basis points this morning, bringing the policy rate down to 2.75%, within the ne ...

read moreInterest Rate Announcement - March 12 2025

March 12, 2025 | Posted by: Matthew J. Charlton

The Bank of Canada has lowered its benchmark rate by 25 bps, bringing it to 2.75%. This is the Bank’s seventh consecutive rate cut.The next rate announcement is scheduled for Wednesday, April 16 ...

read moreCanadian Job Growth Stalls in February - March 7 2025

March 7, 2025 | Posted by: Matthew J. Charlton

Weak Canadian Job Creation Opens The Way For BoC Easing Next Week Today's Labour Force Survey for February was weaker than expected, showing de minimis job growth last month. Employment held steady ...

read moreTrump did it--the trade war started at midnight. Stocks and currencies are falling, but so are interest rates. - March 4 2025

March 4, 2025 | Posted by: Matthew J. Charlton

Trump Did It--Trade War Starts Today Trump has imposed tariffs of 25% on goods coming from Mexico and Canada, 10% on Canadian energy, and an additional 10% on goods from China. He justified these ac ...

read moreCanadian GDP Growth Accelerated in Q4 to 2.6% Compared to an Upwardly Revised 2.2% in Q3 - February 28 2025

February 28, 2025 | Posted by: Matthew J. Charlton

Canada Finished 2024 on a Stronger Note, But Tariffs Remain a Concern This morning, Statistics Canada released the GDP data for the final quarter of last year, showing a stronger-than-expected incre ...

read moreCanadian New Listings Surged in January as Tariff Uncertainty Weighed on Sales - February 19 2025

February 19, 2025 | Posted by: Matthew J. Charlton

Global Tariff Uncertainty Is Not Good For the Canadian Housing Market Canadian MLS® Systems posted a double-digit jump in new supply in January 2025 when compared to December 2024. At the same ...

read moreCanadian CPI Inflation Edged Upward in January Owing To Rising Energy Prices - February 18 2025

February 18, 2025 | Posted by: Matthew J. Charlton

Canadian Inflation Edged Upward to 1.9% Y/Y in January In January, the Consumer Price Index (CPI) rose by 1.9% year over year (y/y), up from 1.8% in December. This rise was primarily due to an upti ...

read moreRE/MAX Partners with Dominion Lending Centres Inc.

February 13, 2025 | Posted by: Matthew J. Charlton

RE/MAX Canada is pleased to announce a new partnership with Dominion Lending Centres (DLC), one of Canada’s largest and most recognized mortgage brokerage brands. This collaboration will creat ...

read moreCanada's January Unemployment Rate Fell to 6.6% On Stronger-Than-Expected Job Growth - February 7 2025

February 7, 2025 | Posted by: Matthew J. Charlton

Stronger-Than-Expected Jobs Report in January Today's Labour Force Survey for January surprised on the high side as businesses expanded employment despite threats of a tariff war with the US. Accor ...

read moreEconomic Insights from Dr. Sherry Cooper - February 4 2025

February 4, 2025 | Posted by: Matthew J. Charlton

Wall Street reacted positively to Trump’s initial tariff backpedalling, pushing US equity futures higher. This is a sign that he may pursue a less protectionist approach; for now, it is a boon ...

read moreTrump Tariff Policy Blasted Around the World - February 3 2025

February 3, 2025 | Posted by: Matthew J. Charlton

Noone Benefits From Tariffs Despite having negotiated the current trade agreement among the U.S., Mexico, and Canada during his first administration, Donald Trump broke the terms of that treaty on ...

read moreThe Bank of Canada Cuts The Overnight Rate By 25 Bps - January 29 2025

January 29, 2025 | Posted by: Matthew J. Charlton

Bank of Canada Cuts Policy Rate By 25 Basis Points The Bank of Canada (BoC) reduced the overnight rate by 25 basis points this morning, bringing the policy rate down to 3.0%. The market had anticip ...

read moreInterest Rate Announcement - January 29 2025

January 29, 2025 | Posted by: Matthew J. Charlton

The Bank of Canada has lowered its benchmark interest rate by 25 bps to 3.00% This is the Bank’s sixth consecutive rate cut.The next rate announcement is scheduled for Wednesday, March 12, 2025. ...

read moreCanadian Inflation Falls to 1.8% y/y in December - January 21 2025

January 21, 2025 | Posted by: Matthew J. Charlton

Positive News On The Inflation Front The Consumer Price Index (CPI) increased by 1.8% year-over-year in December, a slight decrease from the 1.9% rise in November. The main contributors to this slo ...

read moreImpact of Trump Tariffs On Canadian Housing Activity - January 20 2025

January 20, 2025 | Posted by: Matthew J. Charlton

The Impact of Tariffs on Canadian Housing Markets Today is President Trump's inauguration day in the US, and contrary to earlier threats, officials have announced that he will not impose new tariffs ...

read moreMarket Outlook for 2025

January 16, 2025 | Posted by: Matthew J. Charlton

As we begin a new year and gear up for the Spring season, it’s the perfect time to explore the 2025 market outlook. Here’s what to expect for housing sales, prices, interest rates, and th ...

read moreCanadian Existing Home Sales Edged Downward in December - January 15 2025

January 15, 2025 | Posted by: Matthew J. Charlton

The Canadian Housing Market Ends 2024 On a Weak Note Home sales activity recorded over Canadian MLS® Systems softened in December, falling 5.8% compared to November. However, they were still 13 ...

read moreStrongest Canadian Employment Report In Nearly Two Years - January 10 2025

January 10, 2025 | Posted by: Matthew J. Charlton

Stronger-Than-Expected Jobs Report in December Today’s Labour Force Survey for December was much stronger than expected, as many thought the Canada Post strike would have a larger impact. Emp ...

read more2024 Mid-Year Consumer Survey Results - December 20 2024

December 20, 2024 | Posted by: Matthew J. Charlton

The 2024 Mid-Year Report from Mortgage Professionals Canada provides key insights into the current housing market and consumer sentiments: Renewed Optimism Amidst Concerns: Falling interest rates ha ...

read moreCanadian Headline Inflation Was 1.9% y/y With Monthly Inflation Unchanged - December 18 2024

December 18, 2024 | Posted by: Matthew J. Charlton

Good News On The Inflation Front The Consumer Price Index (CPI) rose 1.9% year-over-year (y/y) in November, down from a 2.0% increase in October. Slower price growth was broad-based, with prices for ...

read moreCanadian home sales rose again in November as new listings declined and prices rose - December 17 2024

December 17, 2024 | Posted by: Matthew J. Charlton

The Canadian Housing Market Strengthens Further Home sales activity recorded over Canadian MLS® Systems rose again in November, building on October’s surprise jump. Sales were up 2.8% m/m ...

read moreFall Economic Statement Delivered Despite Chrystia Freeland's Resignation - December 16 2024

December 16, 2024 | Posted by: Matthew J. Charlton

Chrystia Freeland Resigns On The Day of The Fall Economic Statement Finance Minister Freeland rocked markets today by submitting her resignation from Cabinet. Trudeau had asked her to take another ...

read moreThe Bank of Canada Cuts Its Policy Rate By Another 50 Basis Points - December 11 2024

December 11, 2024 | Posted by: Matthew J. Charlton

The Surge In Canadian Unemployment Keeps Another Jumbo Rate Cut In Play In December The BoC slashed the overnight rate by 50 bps this morning, bringing the policy rate down to 3.25%. The market had ...

read moreInterest Rate Announcement - December 11 2024

December 11, 2024 | Posted by: Matthew J. Charlton

The Bank of Canada has lowered its benchmark rate by 50 bps, bringing it down to 3.25%. This marks the fifth consecutive cut since June. 'The Bank of Canada's decision to lower the interest policy rat ...

read moreNovember Jobless Rate Surges to 6.8% in Canada Despite Strong Jobs Growth - December 6 2024

December 6, 2024 | Posted by: Matthew J. Charlton

The Surge In Canadian Unemployment Keeps Another Jumbo Rate Cut In Play In December Before the release of today's Canadian Labour Force Data, the odds favoured a 25 basis point drop in the overnigh ...

read moreEconomic Insights from Dr. Sherry Cooper - December 3 2024

December 3, 2024 | Posted by: Matthew J. Charlton

There is an unprecedented disparity between the economic and financial situation in the US and Canada. The Canadian economy is far more interest-sensitive than the US and, therefore, slowed more dra ...

read moreCanadian Inflation increased to 2.0% y/y in October--up from 1.6% in September owing to a smaller decline in gasoline prices - November 19 2024

November 19, 2024 | Posted by: Matthew J. Charlton

October Inflation Rose to 2.0% As Gasoline Price Declines Were More Muted The Consumer Price Index (CPI) rose 2.0% year-over-year in October, up from a 1.6% increase in September. Gasoline prices fel ...

read moreCanadian Home Sales Surge in October Led by the GVA and GTA - November 15 2024

November 15, 2024 | Posted by: Matthew J. Charlton

The Canadian Housing Market Shows Signs of Life Canadian home sales surged to their highest level in more than two years as the Bank of Canada cut interest rates, bringing buyers back into the mark ...

read moreCanadian Weak Job Gains in October Keeps Jumbo Rate Cut In Play - November 8 2024

November 8, 2024 | Posted by: Matthew J. Charlton

Weaker-Than-Expected October Jobs Report Keeps Jumbo Rate Cut In-Play in December Statistics Canada released October employment data today. The data showed a marked slowdown in job growth, undersco ...

read moreJumbo Rate Cut by the Bank of Canada - October 23 2024

October 23, 2024 | Posted by: Matthew J. Charlton

Bank of Canada Cuts Policy Rate By 50 BPs After three consecutive 25 bp rate cuts, the BoC slashed the overnight rate by 50 bps this morning, bringing the policy rate down to 3.75%. The market had ...

read moreInterest Rate Announcement - October 23 2024

October 23, 2024 | Posted by: Matthew J. Charlton

The Bank of Canada has lowered its benchmark rate by 50 bps, bringing it down to 3.75%. This marks the fourth consecutive cut since June.'The Bank of Canada's decision to lower the interest rate to 3. ...

read moreHome sales have trended up since rate cuts began, but new listings have risen faster - October 17 2024

October 17, 2024 | Posted by: Matthew J. Charlton

Canadian Housing Market Stuck In A Holding Pattern Following the Bank of Canada’s third interest rate cut of the year, national home sales increased slightly in September compared to August. ...

read moreCanadian inflation fell to 1.6% y/y in September, the smallest yearly increase since 2021 - October 16 2024

October 16, 2024 | Posted by: Matthew J. Charlton

More Good News On The Canadian Inflation Front The Consumer Price Index (CPI) rose 1.6% year over year in September, the slowest pace since February 2021 and down from a 2.0% gain in August 2024. The ...

read moreStronger Than Expected Canadian Jobs Report for September Reduces the Chances of a 50-bp Rate Cut on October 23 - October 15 2024

October 15, 2024 | Posted by: Matthew J. Charlton

Stronger-Than-Expected September Jobs Report Reduces Prospect Of Larger Rate Cuts Statistics Canada released September employment data recently, showing a marked uptick in job growth and the first de ...

read moreEconomic Insights from Dr. Sherry Cooper - October 2 2024

October 2, 2024 | Posted by: Matthew J. Charlton

Two significant developments in September will have a lasting positive impact on Canadian housing activity. First were Ottawa’s measures to make housing more affordable. Second was the Fed&rsq ...

read moreGreat News On the Canadian Inflation Front in August - September 17 2024

September 17, 2024 | Posted by: Matthew J. Charlton

More Good News On The Canadian Inflation Front The Consumer Price Index (CPI) rose 2.0% year over year in August, the slowest pace since February 2021, and down from a 2.5% gain in July 2024. Core in ...

read moreAugust Housing Activity Flat Despite Rate Cuts - September 17 2024

September 17, 2024 | Posted by: Matthew J. Charlton

Canadian Housing Market Stuck In A Holding Pattern National home sales increased in June following the Bank of Canada’s first interest rate cut since 2020, and activity posted another slight ...

read moreWeak Canadian Labour Force Survey Sets The Stage For Further Rate Cuts - September 6 2024

September 6, 2024 | Posted by: Matthew J. Charlton

Weaker-Than-Expected August Jobs Report Raises Prospect Of Larger Rate Cuts Statistics Canada released August employment data today, showing continued growth in excess supply in labour markets nation ...

read moreBank of Canada Cuts Policy Rate By 25 bps to 4.25% - September 4 2024

September 4, 2024 | Posted by: Matthew J. Charlton

Bank of Canada Cuts Rates Another Quarter Point Today, the Bank of Canada cut the overnight policy rate by another 25 basis points to 4.25%. This is the third consecutive decrease since June. The B ...

read moreInterest Rate Announcement - September 4 2024

September 4, 2024 | Posted by: Matthew J. Charlton

As was widely expected, the Bank of Canada today lowered its benchmark interest rate by 25 bps, bringing it to 4.25%. This is the Bank’s third consecutive rate cut following a previous cut in Ju ...

read moreEconomic Insights from Dr. Sherry Cooper - September 3 2024

September 3, 2024 | Posted by: Matthew J. Charlton

As the Bank of Canada cuts interest rates, housing activity has remained relatively weak. Existing home sales were well below historical averages in July, while new listings edged upward. Prices hav ...

read moreCanadian Q2 Real GDP Growth A Bit Stronger Than Expected, But Per Capita Real GDP Falls for The Fifth Consecutive Quarter - August 30 2024

August 30, 2024 | Posted by: Matthew J. Charlton

Q2 Canadian Growth, Boosted By Record Population Gains, Slows In June And July Canada's economy grew a bit more than expected in the second quarter, but falling per-capita gross domestic product an ...

read moreCanadian Inflation Cools to 2.5% y/y in July, Ensuring BoC Rate Cut on Sept 4 - August 20 2024

August 20, 2024 | Posted by: Matthew J. Charlton

More Good News On The Canadian Inflation Front Inflation in Canada decelerated once again in July to its slowest pace in three years, assuring the central bank will cut rates for the third consecutiv ...

read moreCanadian Housing Market On Pause In July - August 15 2024

August 15, 2024 | Posted by: Matthew J. Charlton

Canadian Housing Market Paused In July Despite the continued decline in interest rates, the Canadian housing market saw summer doldrums last month. The Canadian Real Estate Association (CREA) annou ...

read moreCanadian Employment Growth Stalled In July, While the Jobless Rate Held Steady at 6.4% – August 9 2024

August 9, 2024 | Posted by: Matthew J. Charlton

Weaker-Than-Expected July Jobs Report Keeps BoC Rate Cuts In-Play Canadian employment data, released today by Statistics Canada, showed a continued slowdown, which historically would have been a harb ...

read moreEconomic Insights from Dr. Sherry Cooper

August 2, 2024 | Posted by: Matthew J. Charlton

Bank of Canada Rate Cut: Economic Trends and Housing Market Predictions All eyes were on The Bank of Canada last month as they cut interest rates by 25 basis points again during their July 24th meeti ...

read moreInterest Rate Announcement – July 24 2024

July 24, 2024 | Posted by: Matthew J. Charlton

In its statement, the Bank said, price pressures are “continuing to ease” and that inflation is expected to move closer to 2%. It cautioned that price pressures remain in some parts of the ...

read moreCanadian Inflation Decelerates to 2.7% – July 16 2024

July 16, 2024 | Posted by: Matthew J. Charlton

Canadian Inflation Fell in June, Setting the Stage For BoC Rate Cut Inflation unexpectedly slipped 0.1% (not seasonally adjusted) in June, following a 0.6% increase in May. This was the first decline ...

read moreJune Home Sales In Canada Show Early Signs Of A Pick-Up After BoC Easing – July 12 2024

July 12, 2024 | Posted by: Matthew J. Charlton

Early Signs Of Renewed Life In June Housing Markets The Canadian Real Estate Association (CREA) announced today that national home sales rose 3.7% between May and June following the Bank of Canada& ...

read moreWeaker-than-expected Jobs Report Keeps Further BoC Rate Cuts In Play – July 5 2024

July 5, 2024 | Posted by: Matthew J. Charlton

Weaker-Than-Expected June Jobs Report Keeps BoC Rate Cuts In Play Canadian employment data, released today by Statistics Canada, showed a marked slowdown, which historically would have been a harbing ...

read moreCanadian CPI Inflation Rose in May, Reducing the Chances of a July Rate Cut – June 25 2024

June 25, 2024 | Posted by: Matthew J. Charlton

Canadian Inflation Rose In May, Surprising Markets Inflation unexpectedly rose in May, disappointing the Bank of Canada as it deliberates the possibility of another rate cut next month. The Consume ...

read moreCanadian Housing Market Was Quiet In May – June 17 2024

June 17, 2024 | Posted by: Matthew J. Charlton

May Was Another Sleepy Month For Housing The Canadian Real Estate Association (CREA) announced today that national home sales fell 0.6% in May, remaining slightly below the average of the past ten ...

read moreMay employment growth in Canada stalled as the unemployment rate ticked up to 6.2% – June 7 2024

June 7, 2024 | Posted by: Matthew J. Charlton

May Jobs Report In the first major data release since the Bank of Canada cut interest rates on Wednesday, Statistics Canada Labour Force Survey for May showed a marked slowdown from the April surge. ...

read moreBank of Canada Cuts Overnight Rate 25 bps to 4.75% – June 6 2024

June 6, 2024 | Posted by: Matthew J. Charlton

A Collective Sigh of Relief As The BoC Cut Rates For the First Time in 27 Months The Bank of Canada boosted consumer and business confidence by cutting the overnight rate by 25 bps to 4.75% and pledg ...

read moreWeaker-than-expected Canadian Q1’24 GDP Growth Increases Odds of a Rate Cut Next Week – May 31 2024

May 31, 2024 | Posted by: Matthew J. Charlton

Odds of a Rate Cut Next Week Rise with Disappointed Canadian GDP Growth The likelihood of a rate cut next week has increased due to disappointing Canadian GDP growth. Real gross domestic product (GDP ...

read moreCanadian CPI Inflation Eased In April, Raising the Chances of a June Rate Cut – May 21 2024

May 21, 2024 | Posted by: Matthew J. Charlton

Canadian Inflation Eased Again in April, Raising the Chances of a June Rate Cut The Consumer Price Index (CPI) rose 2.7% year-over-year (y/y) in April, down from 2.9% in March. This marks the fourth ...

read moreCanadian Home Buyers Remain On the Sidelines In April As New Listings Surge – May 15 2024

May 15, 2024 | Posted by: Matthew J. Charlton

Homebuyers Cautious As New Listings Surge In April The Canadian Real Estate Association (CREA) announced today that national home sales dipped in April 2024 from its prior month, as the number of pro ...

read moreApril Jobs Report Much Stronger Than Expected – May 10 2024

May 10, 2024 | Posted by: Matthew J. Charlton

April’s Strong Job Gains Likely Postpone Rate Cuts Until July Today’s StatsCanada Labour Force Survey for April blindsided economists by coming in much more robust than expected. Employme ...

read moreCanadian Federal Budget 2024: Higher Deficits, Higher Government Spending, And Higher Taxes for the Wealthy – April 17 2024

April 17, 2024 | Posted by: Matthew J. Charlton

Federal Budget Targets Rich Canadians For New Spending The budget focuses on helping Millennial and Gen Z voters experiencing rising housing costs and other inflationary pressures. The government has ...

read moreGreat News On The Canadian Inflation Front – April 16 2024

April 16, 2024 | Posted by: Matthew J. Charlton

Great News On The Inflation Front The Consumer Price Index (CPI) rose 2.9% year-over-year in March, as expected, up a tick from the February pace owing to a rise in gasoline prices, as prices at the ...

read moreHo Hum Housing Data In March Provides Hints Of Coming Strength In Spring – April 12 2024

April 12, 2024 | Posted by: Matthew J. Charlton

Recent Signs Show Housing Activity Will Strengthen Meaningfully In April The Canadian Real Estate Association (CREA) announced today that national home sales for March were roughly flat, while new li ...

read moreBank of Canada Holds Rates Steady For Sixth Consecutive Meeting – April 10 2024

April 10, 2024 | Posted by: Matthew J. Charlton

The Bank of Canada Cautious, But A Rate Cut In June Is Possible Today, the Bank of Canada held the overnight rate at 5% for the sixth consecutive meeting and pledged to continue normalizing its balan ...

read moreCanadian Job Market Whimpers in March While US Roars – April 5 2024

April 5, 2024 | Posted by: Matthew J. Charlton

March’s Weak Jobs Report Sets The Stage For A June Rate Cut Today’s StatsCanada Labour Force Survey for March is much weaker than expected. Employment fell by 2,200, and the employment ra ...

read moreGreat News On The Canadian Inflation Front – March 19 2024

March 19, 2024 | Posted by: Matthew J. Charlton

Great News On The Inflation Front The Consumer Price Index (CPI) rose 2.8% year-over-year in February, down from the 2.9% January pace and much slower than the 3.1% expected rate. Gasoline prices ros ...

read moreCanadian Home Sales Stop Falling In February As Prices Hold Steady – March 18 2024

March 18, 2024 | Posted by: Matthew J. Charlton

February Data Bode Well for a Strong Spring Housing Market The Canadian Real Estate Association announced today that national home sales dipped 3.1% m/m in February while home prices were flat, endin ...

read moreCanadian Employment Gains Strong in February–Up 41,000 – March 8 2024

March 8, 2024 | Posted by: Matthew J. Charlton

February Job Gains Double Forecast As Unemployment Rate Ticks Up Today’s StatsCanada Labour Force Survey for February was a mixed bag and shows the dramatic effect of surging immigration. Canad ...

read moreBoC Holds Rates Steady Waiting To See Further Declines In Core Inflation – March 6 2024

March 6, 2024 | Posted by: Matthew J. Charlton

The Bank of Canada Holds Rates Steady Until Core Inflation Falls Further Today, the Bank of Canada held the overnight rate at 5% for the fifth consecutive meeting and pledged to continue normalizing ...

read moreNo Recession In Canada, As Q4 GDP Growth Rose 1% – February 29 2024

February 29, 2024 | Posted by: Matthew J. Charlton

Still No Recession In Canada Thanks to Huge Influx of Immigrants Real gross domestic product (GDP) rose a moderate 1.0% (seasonally adjusted annual rate), a tad better than expected and the Q3 contra ...

read moreGreat News On The Inflation Front Cause Big Bond Rally – February 20 2024

February 20, 2024 | Posted by: Matthew J. Charlton

Canadian Inflation Falls to 2.9% in January, Boosting Rate Cut Prospects The Consumer Price Index (CPI) rose 2.9% year-over-year in January, down sharply from December’s 3.4% reading. The most ...

read moreCanadian Home Sales Continued to Rise in January as Markets Tightened – February 14 2024

February 14, 2024 | Posted by: Matthew J. Charlton

Canadian Home Sales Continued Their Upward Trend in January As Prices Fell Modestly The Canadian Real Estate Association announced today that home sales over the last two months show signs of recover ...

read moreCanadian January Jobs Report Suggests No Recession In Sight – February 9 2024

February 9, 2024 | Posted by: Matthew J. Charlton

January Jobs Report Dispels Recession Fears Today’s StatsCanada Labour Force Survey for January was a mixed bag and shows the dramatic effect of surging immigration. Canadian employment rose by ...

read moreBank of Canada Holds Rates Steady and Forecasts a Soft Landing – January 24 2024

January 24, 2024 | Posted by: Matthew J. Charlton

The Bank of Canada Holds Rates Steady And Expects Rate Cuts Later This Year Today, The Bank of Canada held the overnight rate at 5% for the fourth consecutive meeting but provided an outlook suggesti ...

read moreCanadian Inflation Rises to 3.4% Y/Y In December – January 16 2024

January 16, 2024 | Posted by: Matthew J. Charlton

A Bumpy Road To The Inflation Target Canada’s headline inflation number for December ’23 moved up three bps to 3.4%, as expected, as gasoline prices didn’t fall as fast as a year ag ...

read moreCanadian Existing Home Sales Surged in December – January 15 2024

January 15, 2024 | Posted by: Matthew J. Charlton

Canadian Home Sales Surprisingly Strong in December Statistics released today by the Canadian Real Estate Association (CREA) show national home sales were up noticeably month-over-month in December ...

read moreDecember Jobs Report In Canada Not As Weak As Headline Suggests – January 5 2024

January 5, 2024 | Posted by: Matthew J. Charlton

Brisk Wage Gains in December Will Keep The BoC Watchful Today’s StatsCanada Labour Force Survey for December was a mixed bag and far more robust than the weak headline figure suggests. Total ...

read moreStronger-Than-Expected Canadian Inflation Will Keep The BoC On The Sidelines For Now – December 19 2023

December 19, 2023 | Posted by: Matthew J. Charlton

Inflation Held Steady In November Today’s inflation report was stronger than expected, unchanged from October’s 3.1% pace. While some had forecast a sub-3% reading, the November CPI data ...

read moreCanadian Housing Markets Bottoming – December 14 2023

December 14, 2023 | Posted by: Matthew J. Charlton

Housing Markets Prepare For A 2024 Rebound Before we get into the details of the November housing market data released this morning by the Canadian Real Estate Association (CREA), big positive news f ...

read moreBank of Canada Holds The Overnight Policy Rate Steady at 5% For the Third Consecutive Meeting – December 6 2023

December 6, 2023 | Posted by: Matthew J. Charlton

The Bank of Canada Held Rates Steady and Took A More Neutral Tone It was widely expected that the Bank of Canada would maintain its key policy rate at 5% for the third consecutive time. It will conti ...

read moreCanadian Employment Gains Stronger than Expected in November, While Unemployment Rose and Hours Worked Fell – December 1 2023

December 1, 2023 | Posted by: Matthew J. Charlton

Jobless Rates Hits 22-Month High–Led by Losses in Finance and Real Estate Employment Today’s StatsCanada Labour Force Survey for November was a mixed bag. Total employment gains were stro ...

read moreQ3 GDP Weaker Than Expected Paving The Way For Future Rate Cuts – November 30 2023

November 30, 2023 | Posted by: Matthew J. Charlton

The Table Is Set For Rate Cuts In 2024 The Canadian economy weakened far more than expected in the third quarter, down 1.1% annually. However, the Q2 figures were revised up significantly from a 0.2% ...

read moreCanadian Inflation Fell to 3.1% (y/y) In October, Ensuring the BoC Holds Rates Steady – November 21 2023

November 21, 2023 | Posted by: Matthew J. Charlton

Good News On the Inflation Front Suggests Policy Rates Have Peaked Today’s inflation report showed a continued improvement, mainly due to falling year-over-year (y/y) gasoline prices. The Octob ...

read moreCanadian Home Sales Slump Accelerates in October – November 15 2023

November 15, 2023 | Posted by: Matthew J. Charlton

Home Sales Plummet In October Housing affordability is the number-one issue causing the significant decline in housing activity, adding to PM Justin Trudeau’s political problems. With the ...

read moreEconomic Forecast from our Chief Economist, Dr. Sherry Cooper – November 7 2023

November 7, 2023 | Posted by: Matthew J. Charlton

The Canadian economy is showing continued signs of slowing as inflation decelerates. This opens the door for a continued pause in rate hikes. Indeed, with any luck, the Bank might have finished its t ...

read moreSoft Jobs Report Weakens Impetus for Further Bank of Canada Rate Hikes – November 3 2023

November 3, 2023 | Posted by: Matthew J. Charlton

Weak October Jobs Report Likely Takes Further BoC Rate Hikes Off The Table Today’s StatsCanada Labour Force Survey for October was weak across the board. Total job gains were meagre, full-time ...

read more

as of November 7 2023 (500 x 350 px).png)