Blog

Clear • Secure • Tailored Mortgage Solutions

Stronger-Than-Expected Canadian Inflation Will Keep The BoC On The Sidelines For Now – December 19 2023

December 19, 2023 | Posted by: Matthew J. Charlton

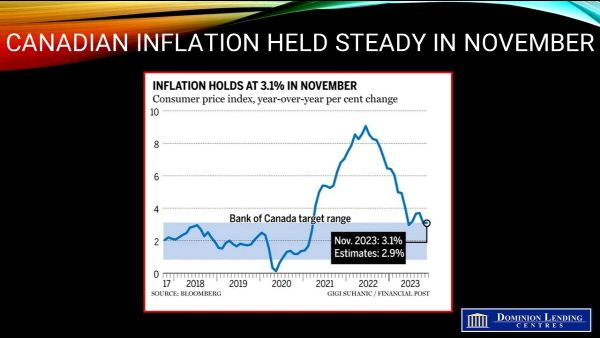

Inflation Held Steady In November

Today’s inflation report was stronger than expected, unchanged from October’s 3.1% pace. While some had forecast a sub-3% reading, the November CPI data posted a welcome slowdown in food and shelter prices. Increases in recreation and clothing offset this–both are discretionary purchases. Cellular services and fuel oil prices declined on a year-over-year basis.

The CPI rose 0.1% from October to November, the same growth rate as in October. The steady pace of annual inflation resulted from the base effects in the energy sector. Gasoline prices fell to a lesser extent month over month in November (-3.5%) than in October (-6.4%). Base effects will also inflate next month’s year-over-year data as well.

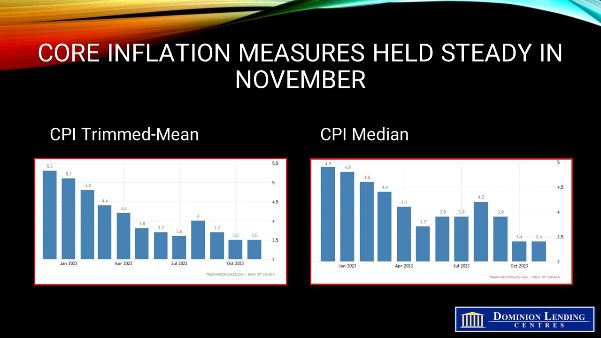

Core prices aligned with the headline figures, as the Bank of Canada’s favourite core measures came in at roughly 3.5%. Even excluding food and energy, the core rose 3.5% y/y. The core data were more favourable at three-month trends, posting at about 2.5%.

Bottom Line

Today’s CPI data show why Governor Tiff Macklem is cautious about rate cuts, but judging from the past three months, core inflation is on a downward trend.

In a speech on Friday, Bank of Canada Governor Tiff Macklem said inflation could get “close” to the bank’s 2% target by late next year, though he also said it was “still too early to consider cutting our policy rate.”

The economy is slowing, labour markets have eased, and price pressures are slowing. The road to 2% inflation will be bumpy, but it remains likely that monetary tightening has peaked, and rate cuts will begin by the middle of next year.

Please note: The source of this article is from Sherry Cooper.