Blog

Clear • Secure • Tailored Mortgage Solutions

Canada Unexpectedly Adds 83,100 Jobs in June, The Biggest Gain of 2025 - July 11 2025

July 11, 2025 | Posted by: Matthew J. Charlton

Canada's Economy Shows Amazing Resilience in June

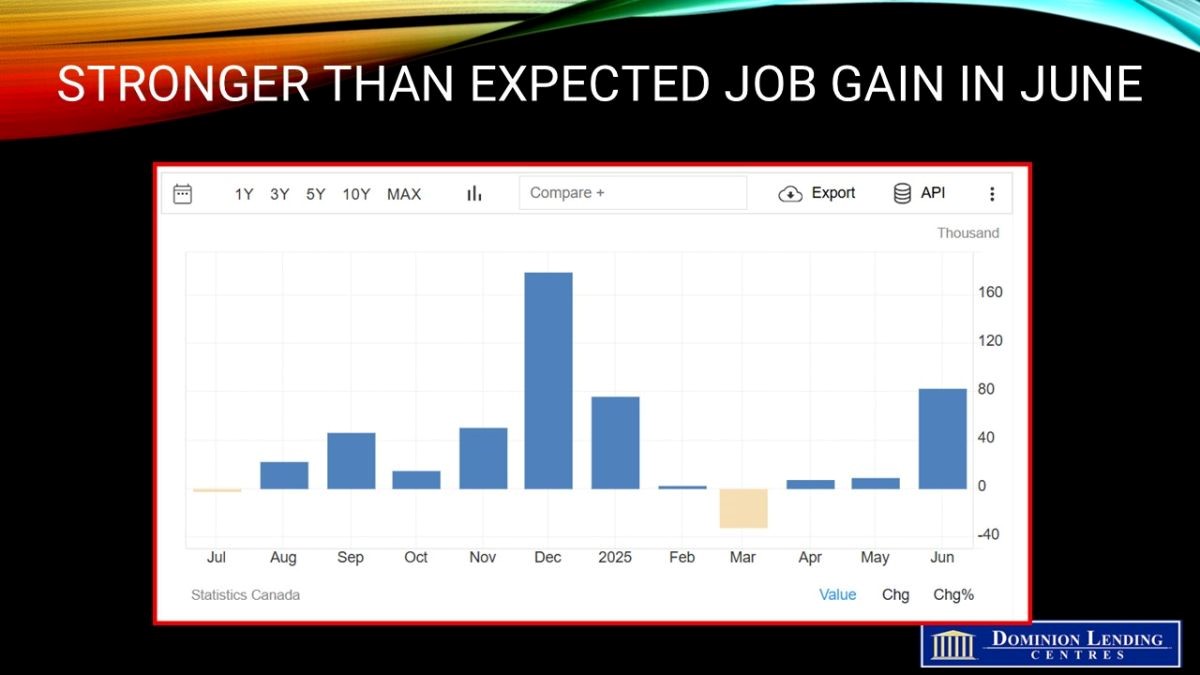

The Canadian economy refuses to buckle under the weight of tariff uncertainty and further potential tariff hikes. The Labour Force Survey, released this morning for June, showed a surprising net new job gain of 83,100 positions, the most significant number of jobs this year. A whopping 84% of the employment gain was in part-time work.

June marked the first time in five months when the economy created enough jobs to keep unemployment from rising, after months of tepid gains and losses. At the same time, Canada added a net of 143,800 jobs over the last six months, the slowest first-half year pace since 2018, excluding the pandemic, with a monthly average of 24,000 job gains.

The central bank has held interest rates at 2.75% for the past two meetings, and its path ahead will depend mainly on how the economy and inflation adapt to tariffs and trade uncertainty. While the economy is expected to slow in the second quarter, firm inflation remains a concern for policymakers, who will set rates again on July 30.

Traders in overnight swaps trimmed expectations of easing at that meeting, putting the odds of a quarter percentage point cut at about 15%, from 30% before the release.

The employment rate—the proportion of the population aged 15 years and older who are employed—increased by 0.1 percentage points to 60.9% in June. The employment rate had previously recorded a cumulative decline of 0.3 percentage points in March and April and had held steady in May.The number of employees increased in both the private (+47,000; +0.3%) and public (+23,000; +0.5%) sectors in June, while the number of self-employed workers was little changed.

The unemployment rate increased 0.1 percentage points to 7.0% in May, the highest rate since September 2016 (excluding 2020 and 2021, during the pandemic). The uptick in May was the third consecutive monthly increase; since February, the unemployment rate has risen by 0.4 percentage points.

There were 1.6 million unemployed people in May, an increase of 13.8% (+191,000) from 12 months earlier. A smaller share of people who were unemployed in April transitioned into employment in May (22.6%), compared with one year earlier (24.0%) and compared with the pre-pandemic average for the same months in 2017, 2018 and 2019 (31.5%) (not seasonally adjusted). This indicates that people face greater difficulties finding work in the current labour market.

The average duration of unemployment has also been rising; unemployed people had spent an average of 21.8 weeks searching for work in May, up from 18.4 weeks in May 2024. Furthermore, nearly half (46.5%) of people unemployed in May 2025 had not worked in the previous 12 months or had never worked, up from 40.7% in May 2024 (not seasonally adjusted).

The layoff rate—representing the proportion of people who were employed in April but became unemployed in May as a result of a layoff—was 0.6%, unchanged from May 2024 (not seasonally adjusted).

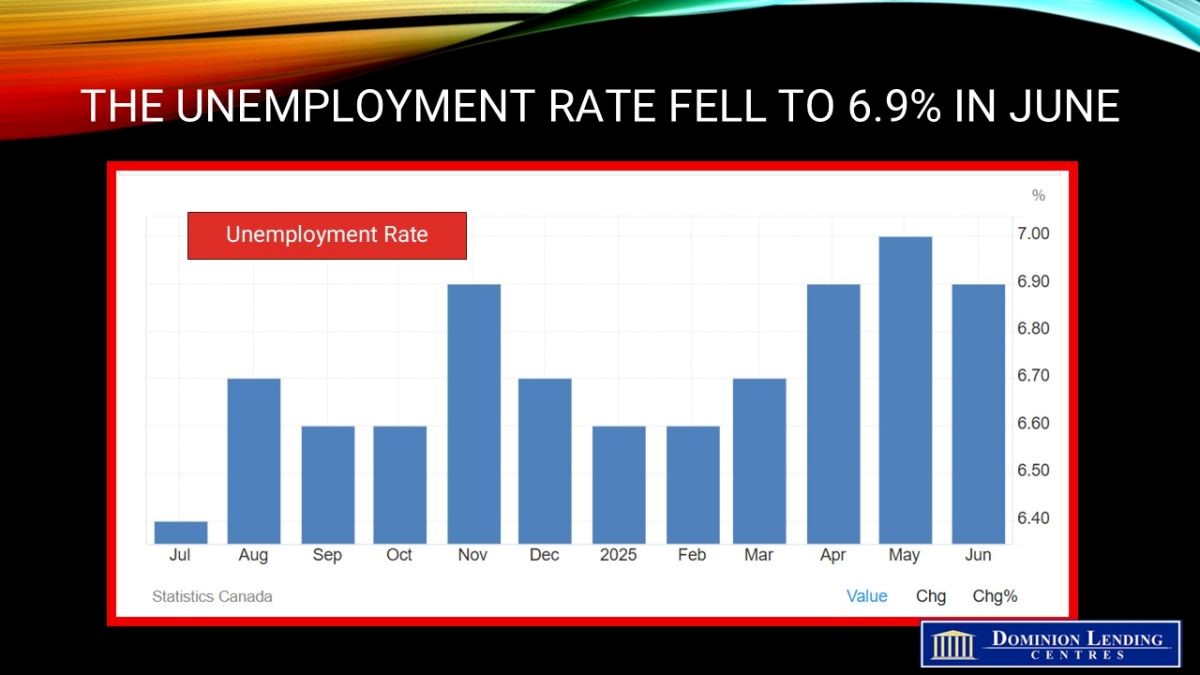

The unemployment rate fell 0.1 percentage points to 6.9% in June, the first decrease since January. Before this decline, the unemployment rate had increased for three consecutive months ending in May 2025, reaching its highest level (7.0%) since September 2016 (excluding 2020 and 2021, during the COVID-19 pandemic).

In June, the unemployment rate among core-aged women fell 0.3 percentage points to 5.4%. Among core-aged men, it was little changed at 6.1%, as the number of job searchers held steady despite the employment gains.

Notably, age 25-54 employment rose 90,600 (which is the most significant increase on record, excluding the 2020-2022 pandemic distortion), lowering their jobless rate to 5.8%, reversing May's increase.

There were 1.6 million unemployed people in June, little changed in the month but up 128,000 (+9.0%) on a year-over-year basis.

Compared with one year earlier, long-term unemployment was up in June 2025. Over one in five unemployed people (21.8%) had been searching for work for 27 weeks or more in June, an increase from 17.7% in June 2024.

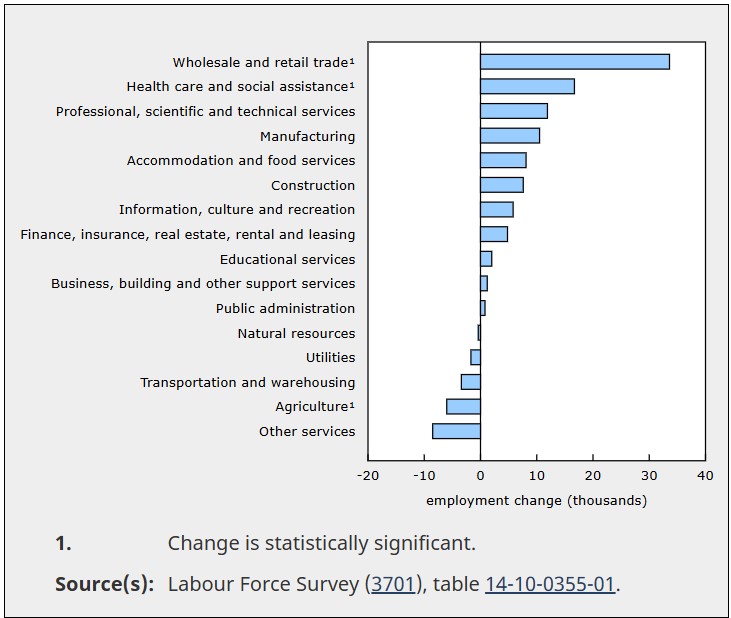

More people are employed in wholesale and retail trade, health care, and social assistance.

Employment in wholesale and retail trade increased by 34,000 (+1.1%) in June, the second consecutive monthly gain. The increase in June was concentrated in retail trade (+38,000; +1.7%). On a year-over-year basis, employment in wholesale and retail trade was up by 84,000 (+2.9%).

Employment change by industry, June 2025

Employment also rose in health care and social assistance (+17,000; +0.6%) in June, the first notable change since December 2024. Compared with 12 months earlier, employment in the industry grew by 78,000 (+2.8%) in June 2025.

Agriculture was the only industry with a notable employment decline (-6,000; -2.6%) in June. On a year-over-year basis, employment in agriculture was little changed. Amazingly, the manufacturing sector showed a considerable job gain in June, rising 10,500, breaking a four-month losing streak. GDP may bounce back in June, but Q2 is still tracking negative, suggesting productivity was much softer, too.

Regionally, Alberta, Ontario and Quebec accounted for the bulk of job gains, while Atlantic Canada was a soft spot. Ontario's jobless rate slipped a tick to 7.8%, still well above the national average and the highest among the larger provinces. That comes in sharp contrast to B.C., where a significant decline in the labour force pulled the unemployment rate down 0.8 ppts to 5.6%, third lowest in the country behind Saskatchewan (4.9%) and Manitoba (5.5%).

Hours worked were solid as well, up 0.5% m/m in June, leaving them up 1.3% annualized for the quarter.

Bottom Line

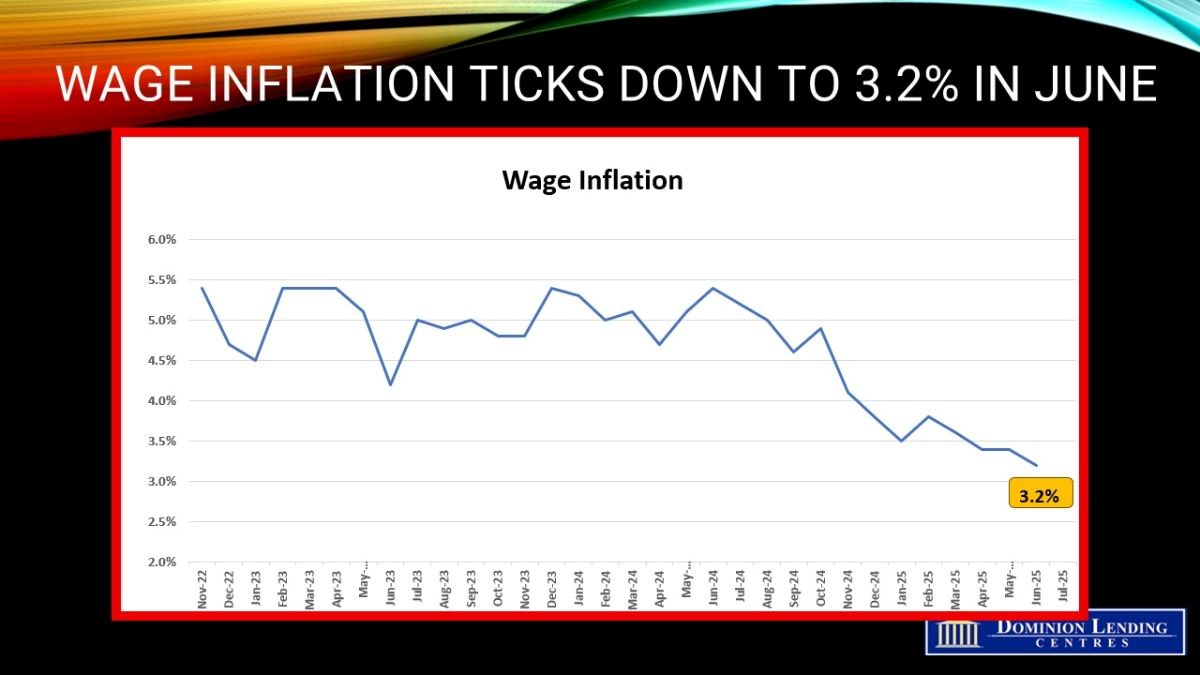

Wage inflation also continues to decelerate, providing some relief for the Bank of Canada. However, with the labour market showing some resilience, the odds of an overnight rate cut in July are minimal.

In other news, Trump Threatens 35% Tariff on Some Canadian Goods: The U.S. will put a 35% tariff on imports from Canada effective Aug. 1, President Trump announced on Thursday evening. But an exemption for goods that comply with the nations' free-trade agreement, the U.S.-Mexico-Canada Agreement, would still apply, accounting for just over 90% of Canadian-US trade. A White House official said, stressing that it could change. WSJ

Barring a sharp decline in next week's CPI data for June, which is unlikely, the strength in today's jobs report and the recently heightened uncertainty on the trade front likely keep the BoC on the sidelines when it meets late this month.

Please note: The source of this article is from Sherry Cooper.